If you install a residential solar system in 2022, the Solar Investment Tax Credit (ITC) lets you credit 26% of the total cost toward your federal income tax.

The ITC drops down to 22% for 2023, after which it’s scheduled to be phased out entirely.

If you do make the deadline, claiming your credit will obviously mean filling out some extra forms. And, though the work involved is minimal, the IRS has a way of making even the simplest tasks a headache.

So, today, we’ll explain how to claim the solar investment tax credit.

Who's eligible

You have to own your solar energy system. If you paid for it with a loan, that’s fine. But, if your system is leased or you’ve arranged to purchase electricity from someone else who owns it, you’re not.

The system has to be located at your primary or secondary residence. If it’s installed at a rental property or someplace else where you never reside, you’re not eligible. You have to own your solar energy system. If you paid for it with a loan, that’s fine. But, if your system is leased or you’ve arranged to purchase electricity from someone else who owns it, you’re not.

Installation of your solar system must be completed in the tax year for which you’re claiming the ITC.

What you'll need

In addition to the standard Form 1040 for the year you’re filing, you’ll need two other IRS forms and their instructions:

schedule 3 (Form 1040), “Additional Credits and Payments.

Form 5695, “Residential Energy Credits”

The only other documents you’ll need are the receipts for your solar installation.

How to claim your credit

Step 1: Calculate how much you're due

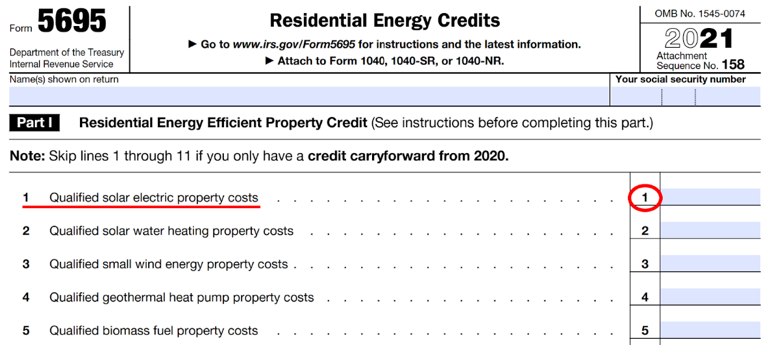

First, you’ll need to determine your “qualified solar electric property costs.” That’s the total cost of your solar energy system, including sales tax, permit fees, inspection costs, and developer fees.

Enter the sum of all those costs on line 1 of Form 5695.

Form 5695 also lists several other eligible home energy improvements:

- Solar water heating (line 2)

- Small wind turbines (line 3)

- Geothermal heat pumps (line 4)

- Biomass systems (line 5).

If you’ve installed any of those in the same tax year, put the relevant amount on the appropriate line.

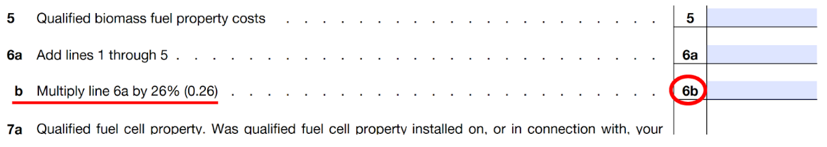

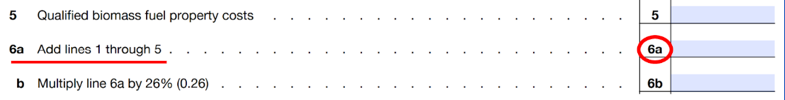

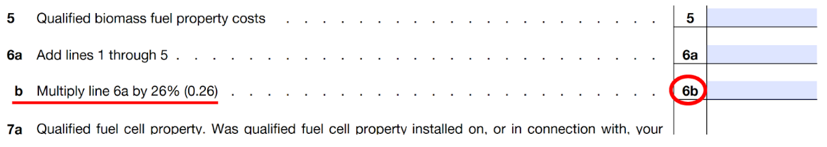

Next, you’ll add up lines 1 through 5 and put the result on line 6a. If your solar system is the only energy credit you’re claiming, line 6a will just repeat the total cost you entered on line 1.

Your next step depends on when your solar system was installed.

- If it was completed in 2022, you’re entitled to a 26% credit. So, you’ll multiply the amount on line 6a by 0.26 and put the result on line 6b.

- For 2023, the ITC drops down to 22%. So, if your system is completed in 2023, you’ll multiply line 6a by 0.22 and put that result on line 6b.

The percentage you’ll use should be on line 6b of Form 5695 for the year you are filing. Forms for 2023 and 2024 aren’t available yet. So, the image below is from 2022, when the ITC was 26%.

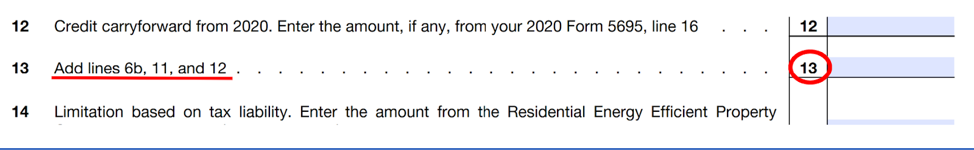

Assuming you’re not claiming a credit for installing fuel cells or carrying forward any credits from last year, enter the amount from line 6b on line 13.

Step 2: Determine your tax liability

Now, you’ll determine whether you owe enough in taxes to get your full 26% credit this year or whether some of it will have to be carried over to next year.

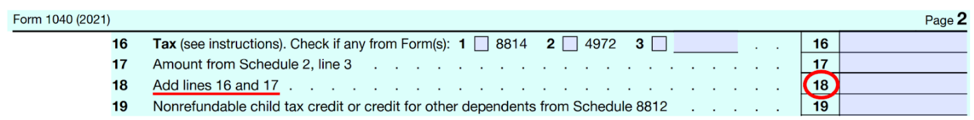

To start, you’ll need to complete your standard 1040 form up to line 18, which will contain the amount you owe before taking any credits into account.

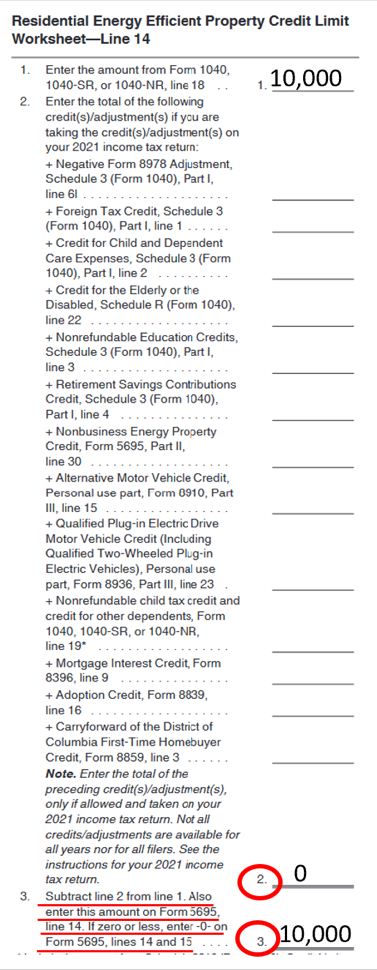

Go to page 4 of the instructions for form 5695, where you’ll see a worksheet to calculate what your tax liability is for the ITC after other credits are considered.

Enter your tax liability from line 18 of form 1040 on line 1 of the worksheet.

Line 2 is for listing various other kinds of credits. Assuming you aren’t taking any of them, all you’ll need to do is re-enter the amount from line 1 on line 3.

For example, if your tax liability from line 18 of form 1040 is $10,000 and you aren’t taking any of the other credits, the worksheet will look like this.

If you are taking some of the other credits, you’ll need to first enter the amounts. Then put their sum on line 2, subtract it from line 1, and put the result on line 3.

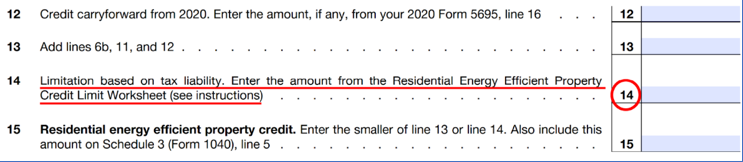

Next, enter the same amount on line 14 of form 5695.

Step 3: Calculate how much you can claim this year

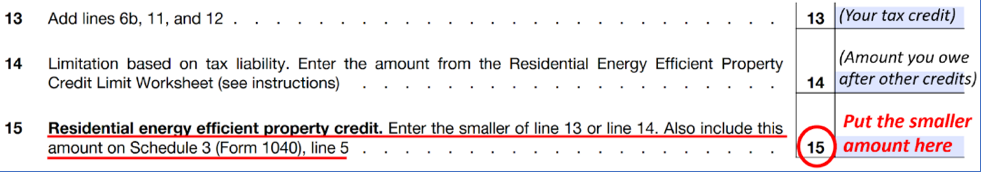

At this point, the full energy tax credit that you’re entitled to will be on Form 5695, line 13, while your tax liability after all other credits are considered will be on line 14.

If line 13 is smaller than line 14, that means you owe enough tax to take the whole credit this year. So, you’ll enter the full credit from line 13 on line 15.

If, on the other hand, line 14 is smaller, you don’t owe enough taxes to claim the whole credit this year. So, you’ll enter the amount you can claim from line 14 on line 15.

Step 4: Add to Schedule 3

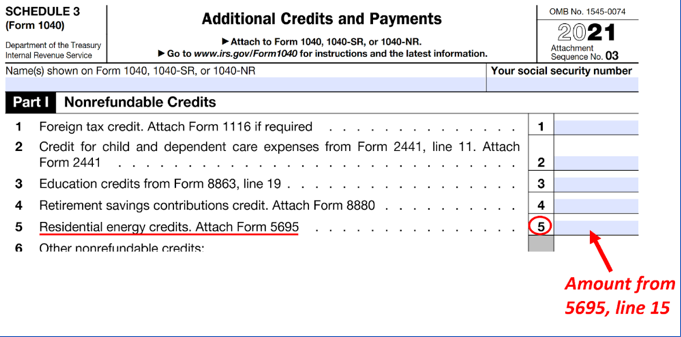

Next, go to Schedule 3 and enter the same amount on line 5.

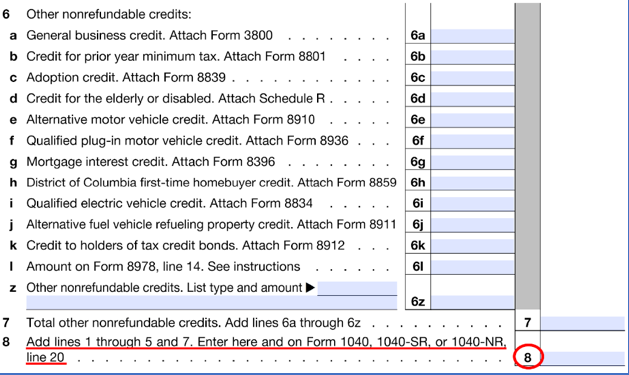

Line 6 of Schedule 3 contains spaces for other non-refundable tax credits. If you're only claiming the ITC, skip both lines 6 and 7 and just enter the amount from line 5 on line 8.

If, on the other hand, you are claiming any of the other credits listed on line 6, enter them, put their sum on line 7, and enter the sum of lines 5 and 7 on line 8.

The next part of Schedule 3 is for refundable tax credits. If you’re not claiming any, you’re done with Schedule 3. If you are claiming some refundable credits, enter them in Part 2.

When you’ve finished Schedule 3, make sure to attach Form 5695 to it.

Step 5: Claim your credit

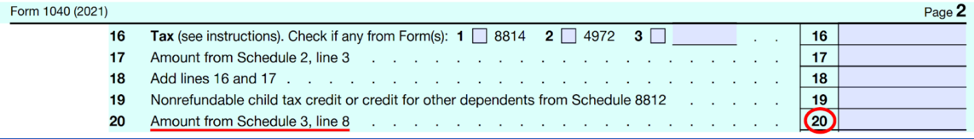

All that’s left is adding your tax credit to Form 1040.

Simply enter the amount from Schedule 3, line 8 on line 20 of form 1040 and you’ve claimed your tax credit.

We’ll leave you to finish the rest of Form 1040.

Just make sure you attach Form 5695 to Schedule 3 and then attach both to your 1040 before mailing it in.