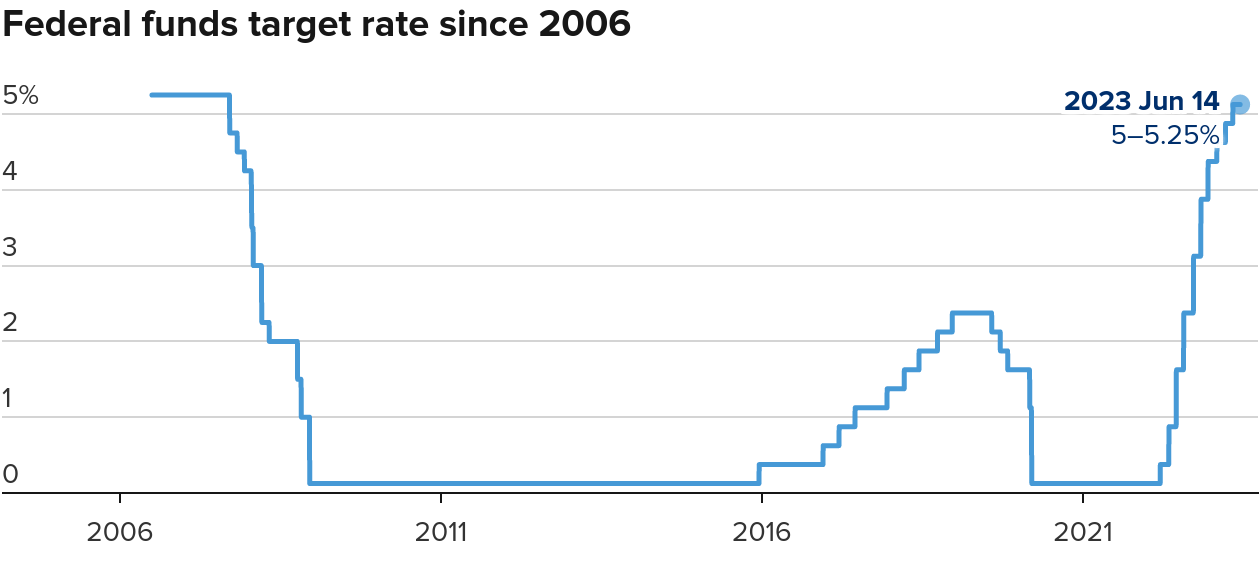

We got some good news and bad news from the Federal Reserve last week.

After meeting for two days, the central bankers decided not to raise interest rates this time around.

That's the good news. The bad news is their announcement that we shouldn't get too excited since more rate hikes are still on the horizon. Exactly how many, however, is a matter of some dispute.

Out of the 18 members who participated in the meeting, only 2 expect interest rates to hold steady til the end of the year

Four members said we can expect just one quarter percentage point hike in 2023

The majority represented by the remaining twelve members all believe we can expect AT LEAST two more quarter-point increases before the year's end.

Finally, three of the twelve were even more pessimistic, with two projecting three rate hikes and one going so far as to say we can expect four more interest hikes before 2023 closes.

The central bankers plan to spend the next six weeks evaluating how much the rate hikes we've already seen this year have managed to curb inflation.

“Holding the target range steady at this meeting allows the Committee to assess additional information and its implications for monetary policy,” the post-meeting statement said.

Interest rates & solar power

What does all this have to do with solar power?

Well, just like other major purchases, most homeowners making the switch to solar power prefer not to pay outright in cash.

Instead, the vast majority finance their solar systems with a loan to be paid off over time.

Once your panels are installed, they’ll generate cost-free electricity. So as long as the monthly payments on your solar loan work out to be less than your average electric bill, transitioning to solar power will save you money.

But, of course, as interest rates continue to rise, the monthly payment for the very same solar loan amount also rises.

So, some homeowners now able to save a significant amount of money by financing a solar system may find going solar to be less financially beneficial as those additional interest rate hikes kick in later this year.

For some, the projected interest rate hikes may even foreclose the possibility of reducing their electricity costs at all.

The upshot is that, if you’re interested in lowering your monthly power bill by transitioning to clean and renewable solar power, the best time to act may be now.